Gift Aid

Your donations and help us raise an extra 25% more

What is Gift Aid

Gift Aid is a scheme available to charities and Community Amateur Sports Clubs (CASCs). It means they can claim extra money from HMRC.

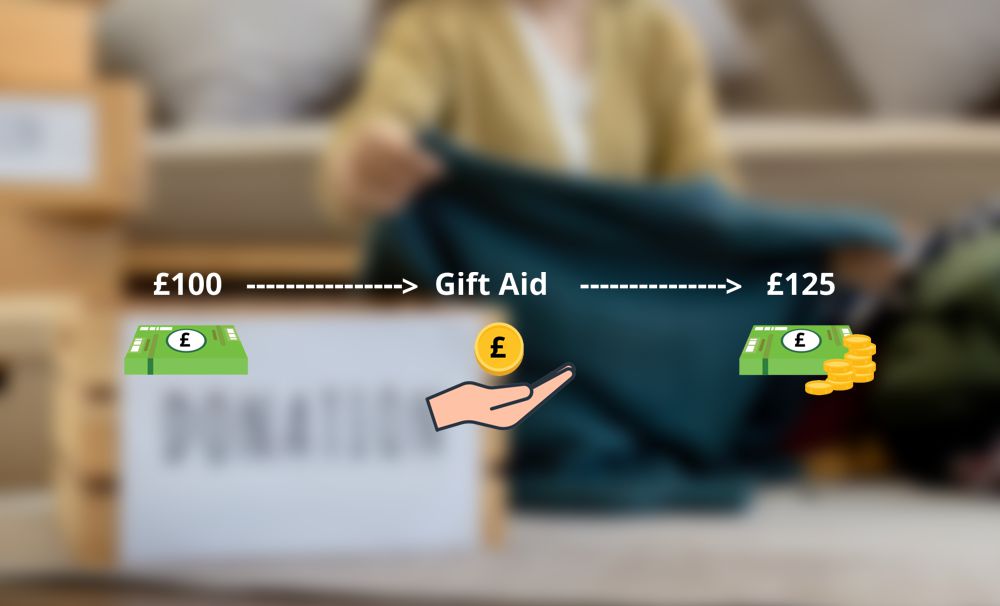

The charity or CASC can claim an extra 25p for every £1 you donate. That’s as long as you’ve paid the basic rate of tax and make the donation from your own funds. That means Gift Aid can increase the value of your donations by 25%, so you can give even more to the causes you care about.

Gift Aid is important for charities, and means millions of pounds extra go to the charity sector. Each time an eligible tax payer donates and forgets to tick the Gift Aid box, the charity misses out.

Are you already a Gift Aid donor with The Community Reuse Shop?

Please present your donor card when making the donation.

Are you Gift Aiding for the first time with The Community Reuse Shop?

Please complete a Gift Aid application form available at the donation point.

Are my donations eligible for Gift Aid?

A charity can claim Gift Aid when you make a monetary donation from your own funds and have paid UK Income and / or Capital Gains Tax during that tax year. The amount of tax you pay needs to be at least equal to the value of Gift Aid the charity or CASC will claim on your donation(s).

If circumstances change and you no longer pay enough tax, it’s important to tell all the charities you support. If you don’t tell them and they continue claiming Gift Aid, you’ll need to pay any difference back to HMRC.